在每個 Fold 中,讓模型用 predict_proba 輸出機率,並將機率值 (針對 Target=1 的機率) 存入 y_pred 中,方便後續回測使用。

def walk_forward_train(X, y, df, train_window=2000, test_window=400, step=400, model_cls=RandomForestClassifier, model_kwargs=None):

"""

sliding-window walk-forward training.

- train_window: 用多少筆資料訓練

- test_window: 每次測試用多少筆

- step: 每次往前移動多少筆 (通常 = test_window)

"""

if model_kwargs is None:

model_kwargs = {"n_estimators":200, "random_state":42, "class_weight": "balanced"}

n = len(X)

folds = []

f1_scores = []

last_model = None

last_test_index = None

last_y_true = None

last_y_proba = None

last_y_hard_pred = None #儲存硬預測 (0或1),用於分類報告

start = 0

# 從 train_window 開始,確保有足夠訓練資料

while start + train_window + test_window <= n:

train_idx = list(range(start, start + train_window))

test_idx = list(range(start + train_window, start + train_window + test_window))

X_train, X_test = X.iloc[train_idx], X.iloc[test_idx]

y_train, y_test = y.iloc[train_idx], y.iloc[test_idx]

model = model_cls(**model_kwargs)

model.fit(X_train, y_train)

# 計算硬預測 (y_hard_pred) 和機率 (y_proba)

y_hard_pred = model.predict(X_test) # 0 或 1

y_proba = model.predict_proba(X_test)[:, 1] # 0.0 到 1.0

#計算 Target=1 (pos_label=1) 的 F1-Score

f1 = f1_score(y_test, y_hard_pred, pos_label=1, zero_division=0)

f1_scores.append(f1)

# move window

start += step

# 儲存最後一個 Fold 的結果

last_model = model

last_test_index = test_idx

last_y_true = y_test

last_y_proba = y_proba # 👈 傳出機率 (P_proba)

last_y_hard_pred = y_hard_pred # 👈 傳出硬預測 (P_hard)

folds.append({

"train_index": train_idx,

"test_index": test_idx,

"model": model,

"y_true": y_test,

"y_proba": y_proba, # 儲存機率

"y_pred": y_hard_pred, # 儲存硬預測 (舊的 y_pred)

"f1_score": f1

})

print(f"\nWalk-forward 訓練完成。共 {len(f1_scores)} 個 Fold。")

if f1_scores:

avg_acc = np.mean(f1_scores)

print(f"📊 平均準確率: {avg_acc:.4f}")

else:

# 如果 scores 為空,則平均準確率為 N/A

print("📊 平均準確率: N/A (無 Fold 執行)")

if not folds:

print("❌ 錯誤:Walk-forward 沒有執行任何 Fold。請檢查資料量是否足夠。")

return None, None, None, None, None

#新增分類報告,以量化模型在類別不平衡下的性能

from sklearn.metrics import classification_report

if last_y_hard_pred is not None and len(last_y_hard_pred) > 0:

acc_last_fold = accuracy_score(last_y_true, last_y_hard_pred)

print(f"✅ 最後一個 Fold 總準確率: {acc_last_fold:.4f}")

print("\n=== 最後一個 Walk-forward 區段的詳細分類報告 (Target=1: 預測漲幅>0.15%) ===")

print(classification_report(last_y_true, last_y_hard_pred,

target_names=['Target=0 (Down/Small)', 'Target=1 (Up)'],

zero_division=0))

# 使用最後一個 Fold 的結果繪製預測圖

plot_predictions(df, last_y_true, last_y_hard_pred, last_test_index, f"Predictions vs Actual (Latest {test_window} bars)")

return last_model, last_test_index, last_y_true, last_y_proba, last_y_hard_pred, folds

walk_forward_train 傳遞回來的 y_pred 已經是機率值。需要在回測中引入一個 信心閾值 (CONFIDENCE_THRESHOLD)。

def backtest_strategy(df, y_true, y_proba, test_index,

initial_capital=10000,

position_size_ratio=0.1,

fee_rate=0.001,

atr_multiplier=1.5,

take_profit_ratio=0.02,

debug=False,

confidence_threshold=0.60): #新增信心閾值

"""

改進版策略回測:

- 支援多空進出場

- 含 ATR 止損與獲利邏輯

- 加入最終平倉

- 修正 equity 曲線與手續費

"""

df_test = df.iloc[test_index].copy().reset_index(drop=True)

df_test["True"] = pd.Series(y_true).reset_index(drop=True)

df_test["Proba"] = pd.Series(y_proba).reset_index(drop=True)

balance = initial_capital

equity_curve = [balance]

trades = []

position, entry_price, entry_capital, entry_units = None, 0, 0, 0

for i in range(1, len(df_test)):

price_now = df_test["close"].iloc[i]

rsi = np.nan_to_num(df_test["RSI"].iloc[i], nan=50)

proba = df_test["Proba"].iloc[i - 1]

atr = np.nan_to_num(df_test["ATR"].iloc[i], nan=0)

# -------------------

# 1️⃣ 進場邏輯

# -------------------

if position is None:

if proba >= confidence_threshold and rsi > 55:

position = "long"

entry_price = price_now

entry_capital = balance * position_size_ratio

entry_units = entry_capital / entry_price

balance -= entry_capital * fee_rate # 手續費

if debug:

print(f"[BUY] @ {price_now:.2f}, Proba={proba:.2f}")

elif (1 - proba) >= confidence_threshold and rsi < 45:

position = "short"

entry_price = price_now

entry_capital = balance * position_size_ratio

entry_units = entry_capital / entry_price

balance -= entry_capital * fee_rate

if debug:

print(f"[SELL] @ {price_now:.2f}, Proba={proba:.2f}")

# -------------------

# 2️⃣ 出場邏輯

# -------------------

elif position == "long":

change = (price_now - entry_price) / entry_price

stop_loss = -atr_multiplier * atr / entry_price

take_profit = take_profit_ratio

if change <= stop_loss or change >= take_profit:

pnl = entry_capital * change

balance += entry_capital + pnl - (entry_capital + pnl) * fee_rate

trades.append(pnl / entry_capital)

if debug:

print(f"[EXIT LONG] @ {price_now:.2f}, PnL={pnl/entry_capital:.2%}")

position, entry_capital, entry_units = None, 0, 0

elif position == "short":

change = (entry_price - price_now) / entry_price

stop_loss = -atr_multiplier * atr / entry_price

take_profit = take_profit_ratio

if change <= stop_loss or change >= take_profit:

pnl = entry_capital * change

balance += entry_capital + pnl - (entry_capital + pnl) * fee_rate

trades.append(pnl / entry_capital)

if debug:

print(f"[EXIT SHORT] @ {price_now:.2f}, PnL={pnl/entry_capital:.2%}")

position, entry_capital, entry_units = None, 0, 0

# -------------------

# 3️⃣ 記錄淨值 (Equity)

# -------------------

current_equity = balance

if position == "long":

current_equity += entry_capital * ((price_now - entry_price) / entry_price)

elif position == "short":

current_equity += entry_capital * ((entry_price - price_now) / entry_price)

equity_curve.append(current_equity)

# -------------------

# 4️⃣ 最後平倉 (Final Closeout)

# -------------------

if position is not None:

final_price = df_test["close"].iloc[-1]

if position == "long":

pnl = entry_capital * ((final_price - entry_price) / entry_price)

else:

pnl = entry_capital * ((entry_price - final_price) / entry_price)

balance += entry_capital + pnl - (entry_capital + pnl) * fee_rate

trades.append(pnl / entry_capital)

if debug:

print(f"[FORCED EXIT] {position.upper()} @ {final_price:.2f}, Final PnL={pnl/entry_capital:.2%}")

# -------------------

# 5️⃣ 結果與報表

# -------------------

if len(equity_curve) < len(df_test):

equity_curve += [balance] * (len(df_test) - len(equity_curve))

df_test["Equity"] = equity_curve

total_return = (balance / initial_capital - 1) * 100

max_drawdown = ((df_test["Equity"].cummax() - df_test["Equity"]) / df_test["Equity"].cummax()).max() * 100

win_rate = (sum([1 for t in trades if t > 0]) / len(trades)) * 100 if trades else 0

# -------------------

# 6️⃣ 繪製曲線

# -------------------

plt.figure(figsize=(12, 6))

plt.plot(df_test["timestamp"], df_test["Equity"], label="Equity Curve", color="blue")

plt.axhline(initial_capital, linestyle="--", color="gray", alpha=0.7)

plt.title("Backtest Equity Curve (v2 Improved)")

plt.xlabel("Time") # 保持 Time 標籤

plt.ylabel("Capital (USDT)")

plt.legend()

plt.xticks(rotation=45) # 加上旋轉,避免時間標籤重疊

plt.tight_layout()

plt.show()

# -------------------

# 7️⃣ 印出統計

# -------------------

print(f"💰 最終資金: {balance:.2f} USDT")

print(f"📈 總報酬率: {total_return:.2f}%")

print(f"📉 最大回撤: {max_drawdown:.2f}%")

print(f"✅ 勝率: {win_rate:.2f}%")

print(f"📊 交易次數: {len(trades)}")

return df_test, trades

修改主程式

if __name__ == "__main__":

# 變數初始化

model, last_test_index, y_true, last_y_proba, last_y_hard_pred, folds = None, None, None, None, None, None

# 設定資料時間範圍

START_DATE = "2025-06-01" # 想從哪一天開始抓

TIMEFRAME = "1h"

# 根據起始日期自動計算 TOTAL_LIMIT

TOTAL_LIMIT = calc_total_limit(START_DATE, timeframe=TIMEFRAME)

# Walk-forward 預設參數 (固定這兩個,讓 TRAIN_WINDOW 變化)

TARGET_FOLDS = 7

FIXED_TEST_WINDOW = 300

FIXED_STEP = 300

RETURN_THRESHOLD = 0.0015 # 0.15% 漲幅才算 Target=1

# 新增信心閾值

CONFIDENCE_THRESHOLD = 0.60 # 60% 信心才進場 (這是一個優化參數)

print(f"===== 抓取與處理資料 (總筆數: {TOTAL_LIMIT}) =====")

# 加入 force_reload=True 以確保抓取足夠數據】

df_raw = fetch_crypto_data(

symbol="BTC/USDT",

timeframe="1h",

start_date=START_DATE, # 從這天開始抓資料

force_reload=True

)

#加入技術指標與 ML 資料處理

df_ind = add_indicators(df_raw)

X, y, df = prepare_ml_data(df_ind, return_threshold=RETURN_THRESHOLD)

#計算 Walk-forward 參數

FINAL_DATA_LEN = len(X)

TRAIN_WINDOW, TEST_WINDOW, STEP, ACTUAL_FOLDS = calculate_walk_forward_params(

total_data_len=FINAL_DATA_LEN,

target_folds=TARGET_FOLDS,

fixed_test_window=FIXED_TEST_WINDOW,

fixed_step=FIXED_STEP

)

if ACTUAL_FOLDS < 1:

print("\n❌ 錯誤:數據量嚴重不足,無法執行 Walk-forward 訓練。請將 START_DATE 設置得更早。")

else:

print("\n===== 開始 Sliding-Window Walk-forward 訓練 =====")

# 傳遞 TRAIN_WINDOW, TEST_WINDOW, STEP 參數

model, last_test_index, y_true, last_y_proba, last_y_hard_pred, folds = walk_forward_train(

X, y, df,

train_window=TRAIN_WINDOW,

test_window=TEST_WINDOW,

step=STEP

)

# 確保只有在有結果時才嘗試回測 (解決您之前的 TypeError)

if model is not None:

print("\n===== 回測最後一個 Walk-forward 區段的績效 =====")

df_test, trades = backtest_strategy(

df,

y_true.astype(int),

last_y_proba,

last_test_index,

confidence_threshold = CONFIDENCE_THRESHOLD

)

print(f"\n✅ 系統已使用 {len(folds)} 個 Fold 訓練並完成回測。")

else:

print("\n⚠️ 因數據量不足,無法執行回測。")

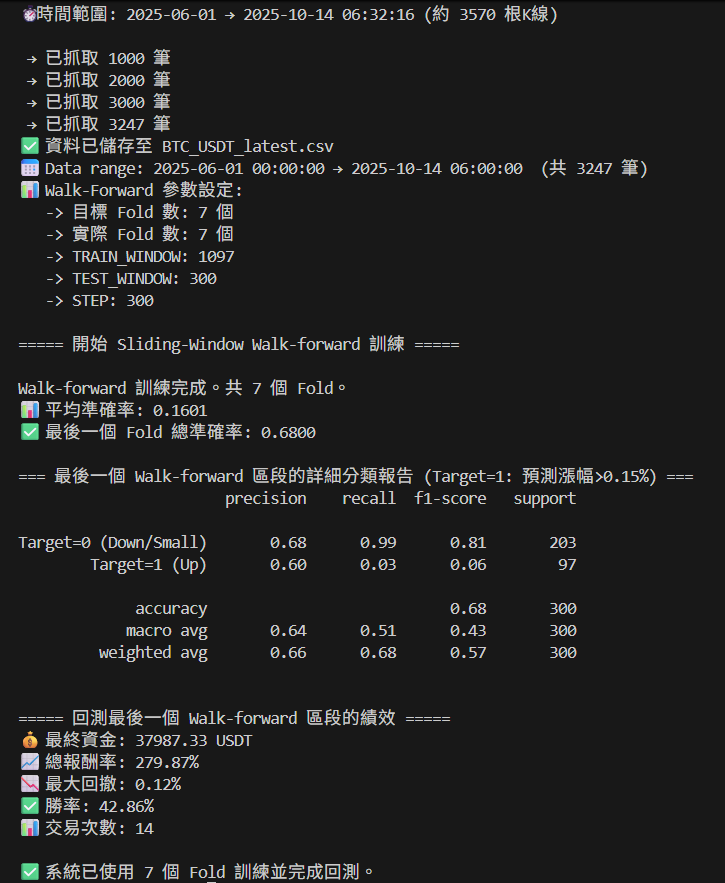

以下是執行後的結果

Precision (精確度) 從一開始的0.24到上次優化後的0.29再到這次優化後的0.60可以說大幅提升。

Recall (召回率) 從一開始的0.14到上次優化後的0.32再到這次優化後的0.03幾乎崩潰了,不敢猜漲。

F1_Score也跌到谷底。

所以下一步我要拯救我的Recall,移除極端平衡,導入機率濾網。